If you ask auto experts about Ather Energy overtaking Ola Electric in the EV two-wheeler race, they’d say, “It’s been coming for a while”.

While Ola Electric’s market share shot up in a matter of months, Ather’s slow-but-steady approach was foretold to be better in the long run.

Not just that, much like the tortoise in Aesop’s fable, Ather Energy has gone past Ola Electric in India’s EV race in terms of monthly sales volume, and even in terms of market cap at the end of trading on Friday (October 10).

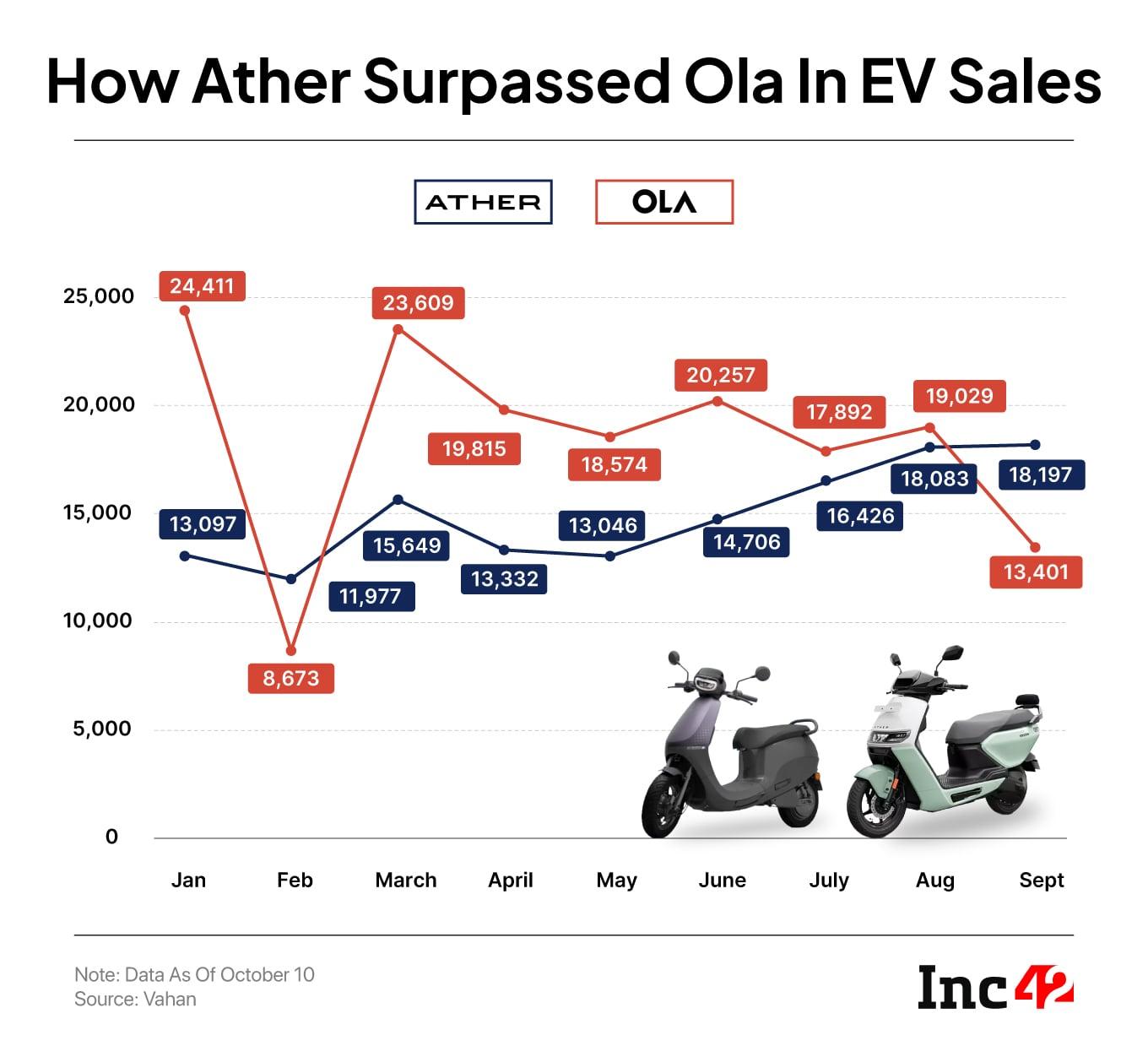

As per Vahan data for September 2025, Ather’s monthly vehicle sales have surpassed Ola Electric’s sales volume by nearly 5,000 units. Ather surpassed Ola Electric for the first time, selling 18,197 units against its rival’s 13,401.

Though Ather started selling its scooters before Ola Electric, their fortunes have been linked together for the last five years. The company founded by IIT Madras graduates Tarun Mehta and Swapnil Jain was outpaced by Bhavish Aggarwal’s Ola Electric in terms of a listing, but Ather has finally managed to surpass its rival.

And this shift isn’t just visible on the roads, it’s being felt in the markets, too. Ola’s sliding EV sales and weak fundamentals have started dragging down another important metric — its stock price.

Ather, on the other hand, is riding the bulls. Its shares touched new record highs multiple times last week, surpassing INR 600 from about an INR 400-level two months back.

Ather’s market cap at INR 22,631 Cr is now beyond Ola Electric’s INR 21,904 Cr, marking a pivotal moment for India’s homegrown EV ecosystem — and perhaps giving another opportunity for other players also to introspect.

How Ather Energy Charged AheadEarlier this year, automotive industry veteran and Anglian Omega Group advisor Deb Mukherji made a remark that has aged remarkably well.

“Automotive is a very serious business,” he told Inc42. “Anyone can sell a bad product for a short time, but in the long run, the products have to be good.”

When he said this, Mukherji wasn’t referring to any particular OEM, but the way automobile businesses function in this sector in general, where brands are built on the back of robust technology, reliable engineering, and customer trust that compounds over decades.

Ather’s approach — which was on the above lines — is finally being reflected in sales volume.

Unlike Ola Electric and many other new-age escooter players in the market, Ather never let product or service issues become a reputational threat. That consistency has strengthened customer loyalty and steadily expanded its user base.

Listing publicly has only added another layer of credibility. The company has managed to keep investor attention high while launching new vehicle lines without losing focus on its existing growth trajectory.

The results are showing. Ather’s market share in India’s electric two-wheeler segment jumped to nearly 17% in Q3 (July–September) of 2025, up from 13.3% in Q1.

The sales volume is reflected in its financials as well, which holds the utmost importance in public markets.

In Q1 of the current fiscal (FY26), Ather’s sales revenue was up over 79% year-on-year at INR 644.6 Cr. More importantly, its net loss narrowed by 3% to INR 178.2 Cr, which was clearly a green flag for the public market investors. Ather is also almost on the verge of turning profitable as well, which adds further to the market optimism.

Analysts believe a combination of these multiple factors have propelled Ather’s stock. The company posted its Q1 numbers on August 4, and starting from that day, its shares have witnessed a sharp gain of over 80% by the middle of last week.

“If anybody has to build a strong automotive company, they have to focus on putting the foundation in place, which is essentially dependent on technology, supply chain, R&D, sales, and after-sales service. Ather has cracked it,” Mukherji said, adding that he had long predicted Ather would eventually overtake Ola Electric’s sales volume.

He also believes the momentum is far from over, and that Ola will see further dips. Though this claim will bear revisiting in the next few months.

Analysts Back Ather’s StockThough Ather shares concluded the week in the red after investors did some profit booking in the last two sessions, SimranJeet Singh Bhatia, senior equity research analyst at Almondz Group, said he expects the company to maintain momentum on the back of its strong improvement in operating parameters, expanding market reach, and increasing market share across regions.

“Ather is expected to surpass Ola Electric, as the former is improving its operating efficiency, while Ola is struggling with its financials,” said, even adding that he would recommend investors to avoid Ola Electric.

Even globally acclaimed brokerage firm HSBC has a similar take. In a research report last week, it reduced both the rating and the price target on Ola Electric while increasing Ather’s price target to INR 700 from INR 600 earlier.

“Ather has established itself as a strong brand in the EV segment, and we think the response for the EL platform (its next-generation scooter platform launched in August) should be better than we previously expected,” said HSBC analysts.

In fact, despite the intensifying competition from the likes of Bajaj Auto and TVS Motor, the brokerage sees Ather’s growth to continue.Broadly, the consensus is clear — Ather Energy is a ‘buy’.

From a technical perspective, LKP Securities’ senior technical analyst, Rupak De sees up to a 10% upside to Ather at its current price, if the market continues to back it even at a slightly lower price.

However, it would not be a surprise to see Ola Electric bouncing back in October or in the rest of the year. At the moment, Ather Energy’s lead, while credible, has come after years of fighting it out with Ola Electric. Will Bhavish Aggarwal push his team to accelerate sales in Q3 after the September setback?

For Ather, the crucial question is around retaining its lead and growing its market share. Legacy OEMs are not giving up the fight and more and more models are coming to compete with both Ola and Ather.

Markets Watch: New Listings, Deals & MoreEven though the competition is close, the market is ripe for penetration and all OEMs continue to remain in the game. For now, Ather is the darling for those betting on EVs in the public market, but Ola Electric is not too far behind.

- WeWork’s Flat Debut: The coworking space provider’s stock listed at INR 646.5 on the BSE, marginally lower than its issue price of INR 648 apiece

- Zappfresh Sees A Bump: Following an extended IPO window, Zappfresh got listed on the BSE SME platform at a 20% premium to its issue price

- ixigo To Raise Fresh Capital: The listed traveltech major is raising INR 1,296 Cr from Prosus through a preferential issue on a private placement basis to fuel its growth

- Citi’s Boost To Eternal: Brokerage Citi reckons Eternal is in for a rally and expressed bullishness on the consumer services giant, particularly on the back of Blinkit’s growth prospects

[Edited by Nikhil Subramaniam]

The post The Ather Energy Upshift appeared first on Inc42 Media.

You may also like

Knives Out director addresses mystery series' future after disappointing Netflix update

Eamonn Holmes halts GB News as Israeli hostages released by Hamas

Skoda offers October 2025: Up to ₹4.5 lakh discount on Kushaq, Slavia, Kylaq and Kodiaq

Rajasthan achieves lowest battery energy storage price in India: Amitabh Kant

Tearful mum tells hostage son 'you're coming home' as he's released by Hamas